JP Morgan Chase & Co., often simply referred to as JP Morgan, is one of the largest and most influential financial institutions in the world. With its long and storied history, the company has played a pivotal role in shaping the global financial landscape. From its origins in the late 19th century to its position as a global leader in banking and financial services today, JP Morgan has been synonymous with financial innovation, strength, and resilience. In this article, we will explore the history, operations, and modern-day significance of JP Morgan, as well as its role in global finance, investment banking, wealth management, and more.

What is JP Morgan?

JP Morgan is a global financial services firm that provides a wide range of investment banking, financial services, asset management, private banking, and treasury services to individuals, corporations, governments, and institutions around the world. The company is headquartered in New York City and operates in more than 100 countries. With assets exceeding $3 trillion (as of 2024), JPMorgan Chase & Co. is a financial powerhouse and one of the largest banks in the United States and the world.

JP Morgan’s services are divided into multiple business segments, including:

- Investment Banking: This division provides advisory services on mergers and acquisitions (M&A), capital raising (equity and debt), and other financial strategies.

- Commercial Banking: This segment offers financial services to small businesses, corporations, and institutions, including loans, treasury services, and payment processing.

- Asset and Wealth Management: JP Morgan offers wealth management services to high-net-worth individuals and families, as well as investment products and services to institutional clients.

- Consumer & Community Banking: This division serves retail customers with banking products like checking and savings accounts, mortgages, credit cards, and auto loans.

A Brief History of JP Morgan

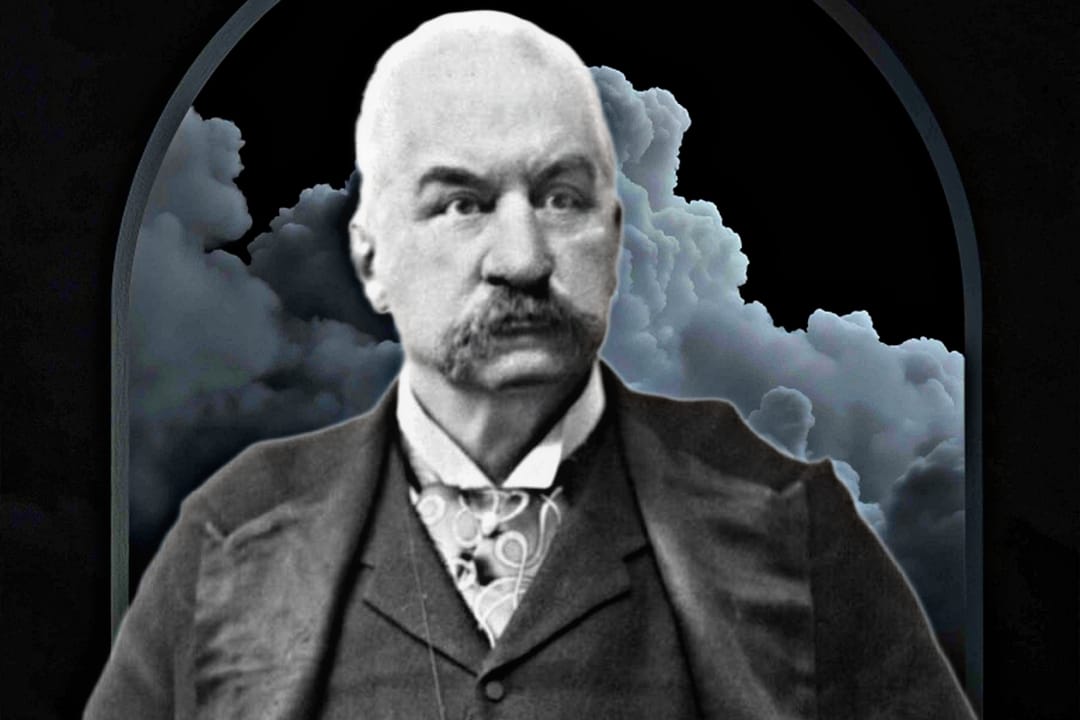

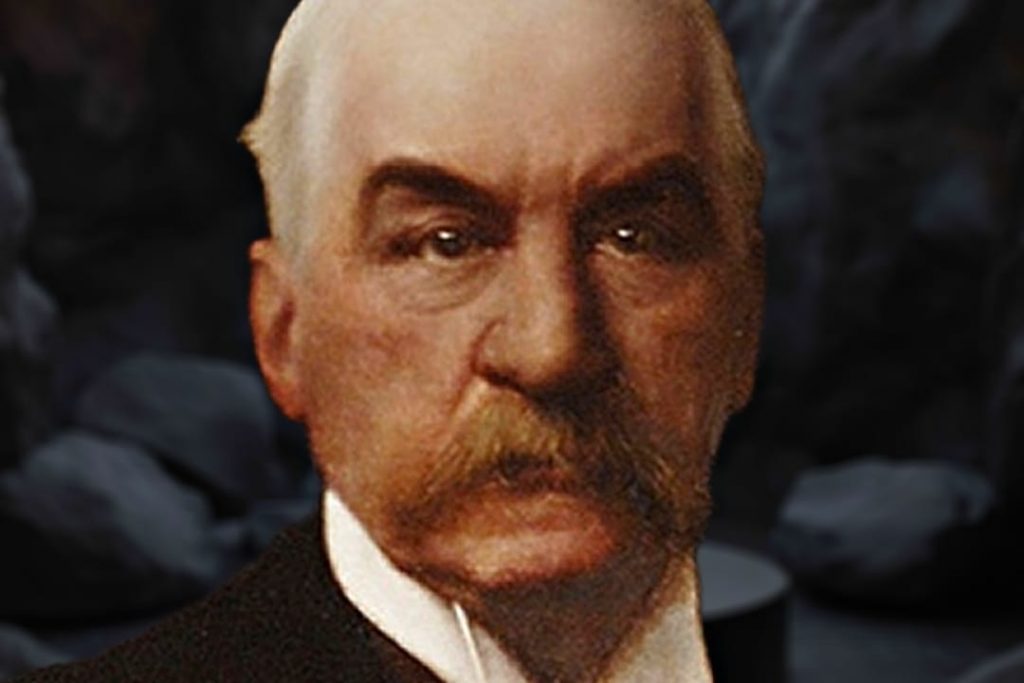

The history of JP Morgan is closely tied to the rise of modern finance and the development of the American financial system. The company’s origins date back to the late 19th century when it was founded as several distinct entities that later merged under the leadership of one of the most influential figures in American finance, J.P. Morgan.

The Early Years

- J.P. Morgan & Co. was founded in 1871 by John Pierpont Morgan, a prominent financier and banker, along with his partners. The firm quickly gained a reputation for its ability to manage large-scale financing projects and offer capital to industrialists in need of funds.

- One of JP Morgan’s most significant early roles was in the railroad industry. In the late 1800s, the United States experienced rapid industrialization, and the railroad sector was critical to the economy. J.P. Morgan & Co. played an instrumental role in financing railroad companies, including the merger of several major railroad lines, which ultimately helped create the giant U.S. Steel Corporation in 1901. This deal, worth $1.4 billion, was the largest corporate merger in history at the time and signaled Morgan’s dominance in the American financial sector.

- J.P. Morgan’s involvement with large corporations continued to grow, and his influence in shaping corporate America made him a figure of immense power. In fact, he was often referred to as the “most powerful banker in America,” and his firm became a key player in U.S. industrial expansion.

The Formation of JP Morgan Chase

The modern JP Morgan is the product of multiple mergers and acquisitions over the decades. The most significant of these events occurred in the 20th century.

- In 1930, J.P. Morgan & Co. merged with Chase National Bank, which was originally founded in 1877 as a commercial bank by John Thompson. This merger resulted in the creation of J.P. Morgan Chase & Co. Despite the merger, the firms maintained their distinct brand identities for several decades.

- Over the years, JPMorgan Chase continued to expand its operations and acquire other banking institutions. Some notable acquisitions included:

- In 2000, Chase Manhattan Corporation (the name it was known by at the time) merged with J.P. Morgan & Co. to form JPMorgan Chase & Co., with a combined balance sheet exceeding $700 billion.

- In 2004, the firm merged with Bank One Corporation, one of the largest banking institutions in the U.S., which helped solidify JPMorgan Chase’s position as one of the top banks globally.

- The Bear Stearns acquisition in 2008 during the global financial crisis further enhanced JP Morgan’s prominence. In a move to stabilize the market, JP Morgan Chase bought the struggling investment bank, expanding its investment banking division significantly.

- JP Morgan Chase also acquired Washington Mutual’s banking operations in 2008, which made the firm the largest savings and loan bank in the U.S. at the time.

The Role in the Global Financial Crisis

The financial crisis of 2008 marked a significant chapter in JP Morgan’s history. Like many financial institutions, the firm faced substantial challenges during the crisis, but it emerged relatively unscathed compared to its competitors. JPMorgan Chase was seen as one of the most resilient financial institutions, largely due to the foresight and risk management strategies put in place by its leadership.

The firm’s acquisition of Bear Stearns and Washington Mutual during the crisis was pivotal, and the swift moves to absorb these firms into JP Morgan Chase helped stabilize the U.S. financial system. JP Morgan Chase’s role in the financial crisis highlighted the bank’s financial acumen and its importance to the global banking system.

The Structure of JP Morgan Chase

Today, JP Morgan Chase & Co. operates through several key divisions, each catering to a different aspect of the financial market:

1. Investment Banking

JP Morgan’s investment banking division is one of the largest and most influential in the world. It provides services in capital markets, including underwriting, advisory, and trading for clients ranging from corporations to governments. The division is well known for its role in major M&A deals, debt issuances, and IPOs.

- Mergers & Acquisitions (M&A): JP Morgan’s M&A advisory services are among the best in the industry, with the bank regularly advising on some of the largest and most complex deals globally.

- Debt & Equity Capital Markets: JP Morgan is a key player in raising capital for corporations, assisting them in issuing stocks, bonds, and other securities.

- Trading & Market Making: The bank also runs large-scale trading operations in various asset classes, including equities, fixed income, commodities, and currencies.

2. Commercial Banking

JP Morgan Chase’s commercial banking division provides financial services to businesses of all sizes, from small and medium-sized enterprises (SMEs) to large corporations. It offers products such as loans, credit lines, treasury services, and payment processing.

3. Asset and Wealth Management

JP Morgan Asset Management (JPMAM) is one of the world’s largest asset managers, with over $2 trillion in assets under management (AUM). The division provides a wide range of investment solutions for institutional investors, high-net-worth individuals, and retail clients. Services include mutual funds, ETFs, hedge funds, and private equity.

The Private Banking division of JP Morgan is one of the leading wealth management firms, offering financial planning, investment advisory, and estate planning services to affluent individuals and families.

4. Consumer & Community Banking

The Consumer & Community Banking division is JP Morgan Chase’s retail banking operation. It provides traditional banking services, including checking and savings accounts, credit cards, mortgages, auto loans, and small business banking. Chase is a household name in the U.S., with millions of customers.

Innovation and Technology in JP Morgan

JP Morgan Chase has long been at the forefront of adopting innovative technologies in the financial sector. The company invests heavily in cutting-edge financial technology (FinTech) to enhance its operations, streamline processes, and improve customer experience.

1. Digital Banking

JP Morgan Chase has been a leader in the digital banking space, with its mobile app and online banking platform being among the most popular and widely used in the industry. The bank continues to enhance its digital offerings, ensuring that customers have access to banking services anytime, anywhere.

2. Blockchain and Cryptocurrency

JP Morgan has also been exploring the world of blockchain technology and cryptocurrencies. In 2017, the firm launched JPM Coin, a digital currency used to facilitate instant payments between institutional clients. Additionally, JPMorgan has been actively researching blockchain applications for improving the efficiency and security of financial transactions.

3. Artificial Intelligence and Machine Learning

JP Morgan uses artificial intelligence (AI) and machine learning (ML) to enhance its trading strategies, risk management, and customer service operations. The firm leverages AI in areas like fraud detection, credit scoring, and wealth management, ensuring it remains competitive in the ever-changing financial landscape.

The Global Impact of JP Morgan

As one of the largest financial institutions globally, JP Morgan has a profound impact on global markets, economies, and industries. It plays a key role in providing liquidity, financing, and investment capital, which in turn fuels economic growth and development.

The firm’s influence extends beyond the financial sector, as it is involved in a variety of philanthropic initiatives through the JP Morgan Chase Foundation, supporting causes related to community development, education, and economic inclusion.

Conclusion

JP Morgan Chase & Co. is a global financial institution with a rich history of success, resilience, and innovation. From its origins in the late 19th century to its status today as one of the largest and most influential banks in the world, JP Morgan has played a pivotal role in shaping the modern financial system. With its diversified business operations, technological innovation, and continued global influence, JPMorgan Chase is likely to remain at the forefront of the banking and financial services industry for years to come.

As the world continues to evolve, JP Morgan’s ability to adapt to new technologies, regulatory challenges, and market shifts will ensure its continued relevance in the global financial ecosystem. Whether through investment banking, commercial services, asset management, or cutting-edge technologies like blockchain and artificial intelligence, JP Morgan Chase will remain a key player in global finance.